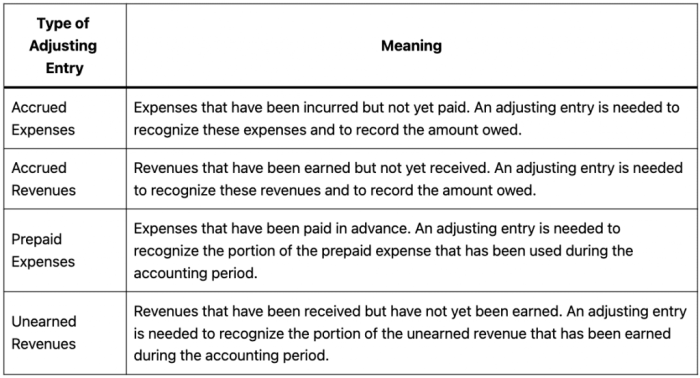

The fees earned but unbilled adjusting entry plays a crucial role in ensuring the accuracy and reliability of financial statements, providing a comprehensive understanding of a company’s financial performance.

This adjustment captures revenue earned but not yet invoiced, aligning financial records with the economic reality of the business.

Introduction to Fees Earned but Unbilled

Fees earned but unbilled represent income that has been earned by a company but has not yet been invoiced or recorded as revenue. It is a common accounting practice in various industries, particularly for professional service firms and businesses that provide services over an extended period.

Adjusting entries for fees earned but unbilled are crucial to ensure the accuracy and reliability of financial statements. These entries allow companies to recognize revenue in the period it is earned, even if the cash has not yet been received.

Identifying Fees Earned but Unbilled

To determine which fees are considered earned but unbilled, the following criteria must be met:

- Services have been performed.

- The amount of fees earned can be reasonably estimated.

- There is an enforceable right to payment.

Examples of services that typically generate fees earned but unbilled include consulting services, legal services, and accounting services.

The amount of fees earned but unbilled is calculated based on the services performed during the accounting period, regardless of whether an invoice has been issued or payment has been received.

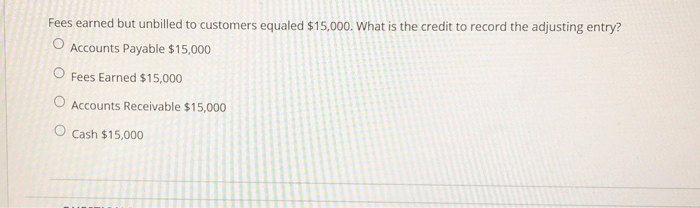

Recording the Adjusting Entry: Fees Earned But Unbilled Adjusting Entry

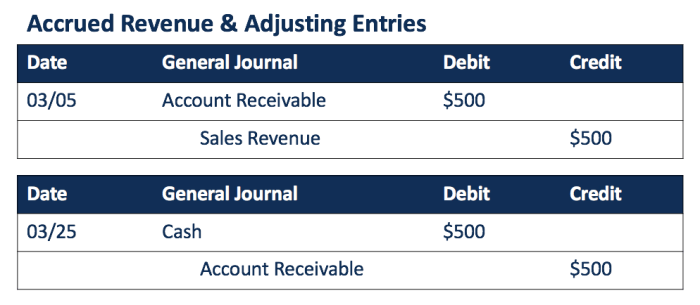

To record the adjusting entry for fees earned but unbilled, follow these steps:

- Debit Accounts Receivable for the amount of fees earned but unbilled.

- Credit Fees Earned Revenue for the same amount.

This adjusting entry increases both Accounts Receivable (an asset) and Fees Earned Revenue (a revenue account) on the balance sheet.

At the beginning of the next accounting period, the adjusting entry should be reversed to avoid overstating revenue and accounts receivable.

Implications for Financial Reporting

Fees earned but unbilled have significant implications for financial reporting:

- They affect the accuracy and reliability of financial statements by ensuring that revenue is recognized in the period it is earned.

- They can impact key financial ratios, such as revenue and profit margin, by increasing both revenue and accounts receivable.

- Companies are required to disclose fees earned but unbilled in their financial reporting to provide transparency and accuracy to investors and other stakeholders.

Examples and Applications

Here are some examples of companies that use fees earned but unbilled accounting:

- Consulting firms

- Law firms

- Accounting firms

Fees earned but unbilled can impact the financial performance of different industries:

- In the consulting industry, fees earned but unbilled can represent a significant portion of total revenue.

- In the legal industry, fees earned but unbilled can provide a buffer against fluctuations in cash flow.

Best practices for managing fees earned but unbilled include:

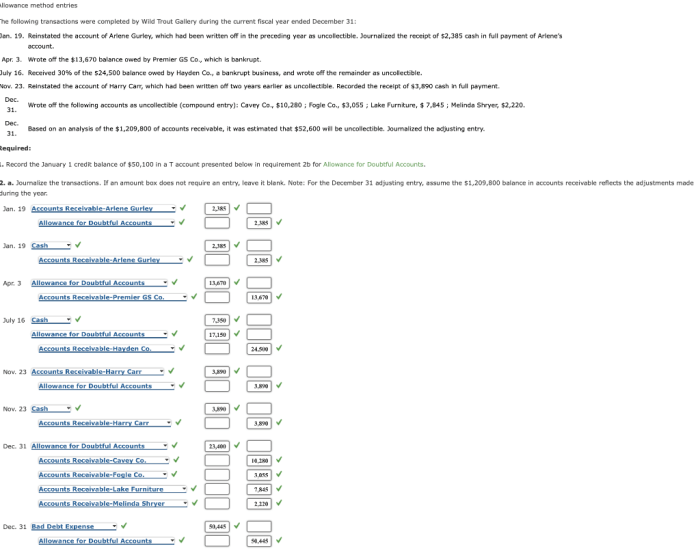

- Maintaining accurate and up-to-date records of services performed.

- Estimating fees earned conservatively to avoid overstating revenue.

- Monitoring accounts receivable regularly to ensure timely collection of fees.

Popular Questions

What is the purpose of the fees earned but unbilled adjusting entry?

To record revenue earned but not yet invoiced, ensuring that financial statements accurately reflect the company’s financial performance.

How is the amount of fees earned but unbilled calculated?

By multiplying the number of units or hours of service provided by the agreed-upon rate.

What is the impact of the adjusting entry on financial statements?

It increases both revenue and accounts receivable, providing a more accurate representation of the company’s financial position.