Scin self cancelling installment note – In the ever-evolving financial landscape, the SCIN Self-Canceling Installment Note emerges as a captivating financing tool that warrants exploration. This comprehensive analysis delves into the intricacies of SCINs, unraveling their key features, legal considerations, and diverse applications, providing a panoramic view of their significance in real estate, business lending, and beyond.

SCINs, characterized by their self-liquidating nature, offer a unique blend of flexibility and affordability, making them a compelling choice for individuals and businesses seeking alternative financing solutions. Their legal and regulatory framework ensures transparency and safeguards the interests of all parties involved, while their tax implications present both opportunities and considerations.

Understanding SCIN

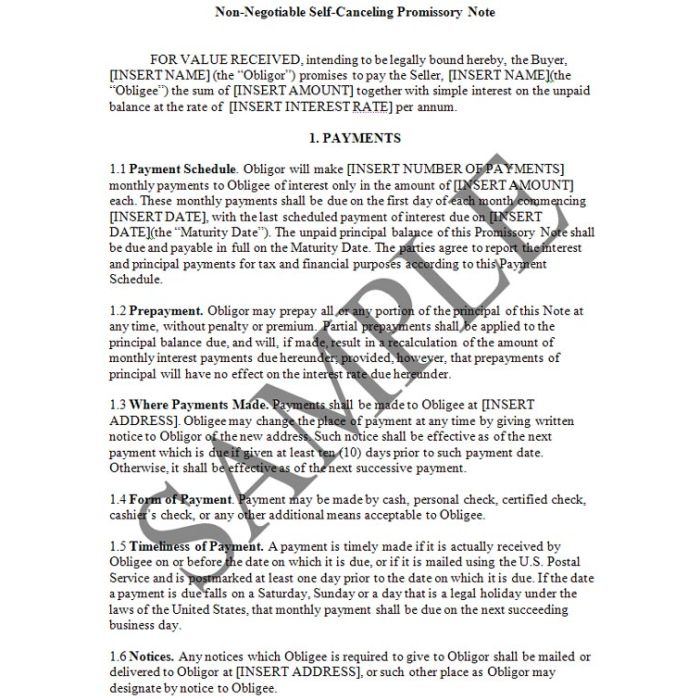

A Self-Canceling Installment Note (SCIN) is a unique type of promissory note that features a built-in mechanism for self-cancellation upon the occurrence of a specified event or the fulfillment of certain conditions. SCINs are typically used in real estate transactions, business lending, and other financing scenarios.

Key Features and Characteristics of SCINs

- Self-Canceling Mechanism: The defining characteristic of SCINs is their ability to cancel themselves automatically upon the occurrence of a specified event or condition.

- Flexibility: SCINs offer a high degree of flexibility in terms of structuring and customizing the terms and conditions, including the trigger event and the cancellation mechanism.

- Conditional Nature: SCINs are conditional instruments, meaning that they become void and unenforceable if the specified event or condition does not occur.

Advantages of Using SCINs

- Protection for Borrowers: SCINs provide borrowers with a level of protection by ensuring that the debt obligation is automatically canceled if the trigger event occurs.

- Simplified Documentation: Compared to traditional promissory notes, SCINs can simplify the documentation process by incorporating the cancellation mechanism directly into the note.

- Cost-Effective: SCINs can be more cost-effective than other financing options, as they eliminate the need for separate cancellation agreements or other legal instruments.

Disadvantages of Using SCINs

- Limited Applicability: SCINs may not be suitable for all types of financing transactions, as they require a specific event or condition to trigger cancellation.

- Legal Complexity: The conditional nature of SCINs can introduce legal complexities and uncertainties, particularly if the trigger event is disputed.

- Enforcement Challenges: Enforcing SCINs can be challenging if the borrower disputes the occurrence of the trigger event or the validity of the cancellation mechanism.

Legal and Regulatory Aspects of SCINs

Legal Framework Governing SCINs

The legal framework governing SCINs varies depending on the jurisdiction in which they are used. However, there are certain general legal principles that apply to SCINs:

- Contract Law: SCINs are considered contracts and are subject to the general principles of contract law, including offer, acceptance, consideration, and mutual assent.

- UCC Article 3: In the United States, SCINs are governed by Article 3 of the Uniform Commercial Code (UCC), which provides a set of rules for negotiable instruments.

- State Laws: Many states have enacted specific laws and regulations governing SCINs, which may impose additional requirements or restrictions.

Key Legal Considerations and Requirements

- Clear and Unambiguous Trigger Event: The trigger event that cancels the SCIN must be clearly and unambiguously defined in the note.

- Proper Execution and Delivery: SCINs must be properly executed and delivered in accordance with the applicable legal requirements.

- Compliance with Disclosure and Notice Provisions: Borrowers must be provided with adequate disclosure and notice of the terms and conditions of the SCIN, including the trigger event and the cancellation mechanism.

Tax Implications of Using SCINs

The tax implications of using SCINs can be complex and depend on the specific circumstances of the transaction. Generally, the cancellation of a SCIN may trigger taxable income for the borrower and/or deductible expenses for the lender.

SCINs in Real Estate Transactions

How SCINs Are Used in Real Estate Financing

SCINs are commonly used in real estate financing transactions, particularly in seller financing and owner financing scenarios.

- Seller Financing: In seller financing, the seller of a property agrees to finance the purchase for the buyer. SCINs can be used to structure the financing, with the cancellation of the note being triggered upon the sale of the property or the occurrence of another specified event.

- Owner Financing: In owner financing, the owner of a property leases the property to a tenant with an option to purchase. SCINs can be used to structure the financing, with the cancellation of the note being triggered upon the exercise of the purchase option.

Benefits and Challenges of Using SCINs for Real Estate Purchases

Benefits

- Flexibility: SCINs offer flexibility in structuring the financing terms, including the trigger event and the cancellation mechanism.

- Cost-Effective: SCINs can be more cost-effective than traditional financing options, as they eliminate the need for separate cancellation agreements or other legal instruments.

Challenges

- Legal Complexity: The conditional nature of SCINs can introduce legal complexities and uncertainties, particularly if the trigger event is disputed.

- Enforcement Challenges: Enforcing SCINs can be challenging if the borrower disputes the occurrence of the trigger event or the validity of the cancellation mechanism.

Examples of SCINs in Real Estate Scenarios

- SCINs can be used to finance the purchase of a property with a seller-financed mortgage. The SCIN would be canceled upon the sale of the property or the occurrence of another specified event, such as the death of the borrower.

- SCINs can be used to finance the purchase of a property with an owner-financed lease-purchase agreement. The SCIN would be canceled upon the exercise of the purchase option by the tenant.

SCINs in Business Lending: Scin Self Cancelling Installment Note

Use of SCINs in Business Lending, Scin self cancelling installment note

SCINs can be used in business lending transactions to provide financing options for businesses.

- Working Capital Loans: SCINs can be used to provide working capital loans to businesses, with the cancellation of the note being triggered upon the occurrence of a specified event, such as the receipt of a certain amount of revenue or the completion of a specific project.

- Equipment Financing: SCINs can be used to finance the purchase of equipment for businesses, with the cancellation of the note being triggered upon the payment of the equipment in full or the occurrence of another specified event.

Advantages and Limitations of Using SCINs for Business Loans

Advantages

- Flexibility: SCINs offer flexibility in structuring the financing terms, including the trigger event and the cancellation mechanism.

- Cost-Effective: SCINs can be more cost-effective than traditional financing options, as they eliminate the need for separate cancellation agreements or other legal instruments.

Limitations

- Limited Applicability: SCINs may not be suitable for all types of business lending transactions, as they require a specific event or condition to trigger cancellation.

- Legal Complexity: The conditional nature of SCINs can introduce legal complexities and uncertainties, particularly if the trigger event is disputed.

FAQs

What is the primary advantage of using SCINs?

SCINs offer the unique advantage of self-liquidation, eliminating the need for a balloon payment at the end of the loan term, resulting in reduced financial burden and increased flexibility for borrowers.

How are SCINs structured in real estate transactions?

In real estate financing, SCINs can be structured in various ways, such as seller financing, where the seller acts as the lender, or through a third-party lender, providing buyers with flexible financing options and potential tax benefits.

What factors should be considered when choosing between SCINs and alternative financing options?

When comparing SCINs to alternative financing options, borrowers should carefully evaluate factors such as interest rates, loan terms, prepayment penalties, and the overall alignment with their financial goals and risk tolerance.